san antonio tax rate property

Ad Be Your Own Property Detective. The City of San Antonio will likely reduce its property tax rate and increase its homestead exemption as part of its annual budget process officials said Wednesday.

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Homestead tax exemptions 100 disabled veterans pay no property tax in the.

. Jurors parking at the garage. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. City of San Antonio Print Mail Center Attn.

Overall there are three phases to real estate taxation namely. The citys conduct of property taxation must not break the states statutory regulations. This city can afford to give more back to our.

View Property Appraisals Deeds Structural Details for Any Address in San Antonio. Box is strongly encouraged for all incoming. Maintenance Operations MO and Debt Service.

Each unit then is given the tax it levied. Ad Public San Antonio Property Records Can Reveal Mortgages Taxes Liens and Much More. 48 rows Find the local property tax rates for San Antonio area cities towns school districts and Texas counties.

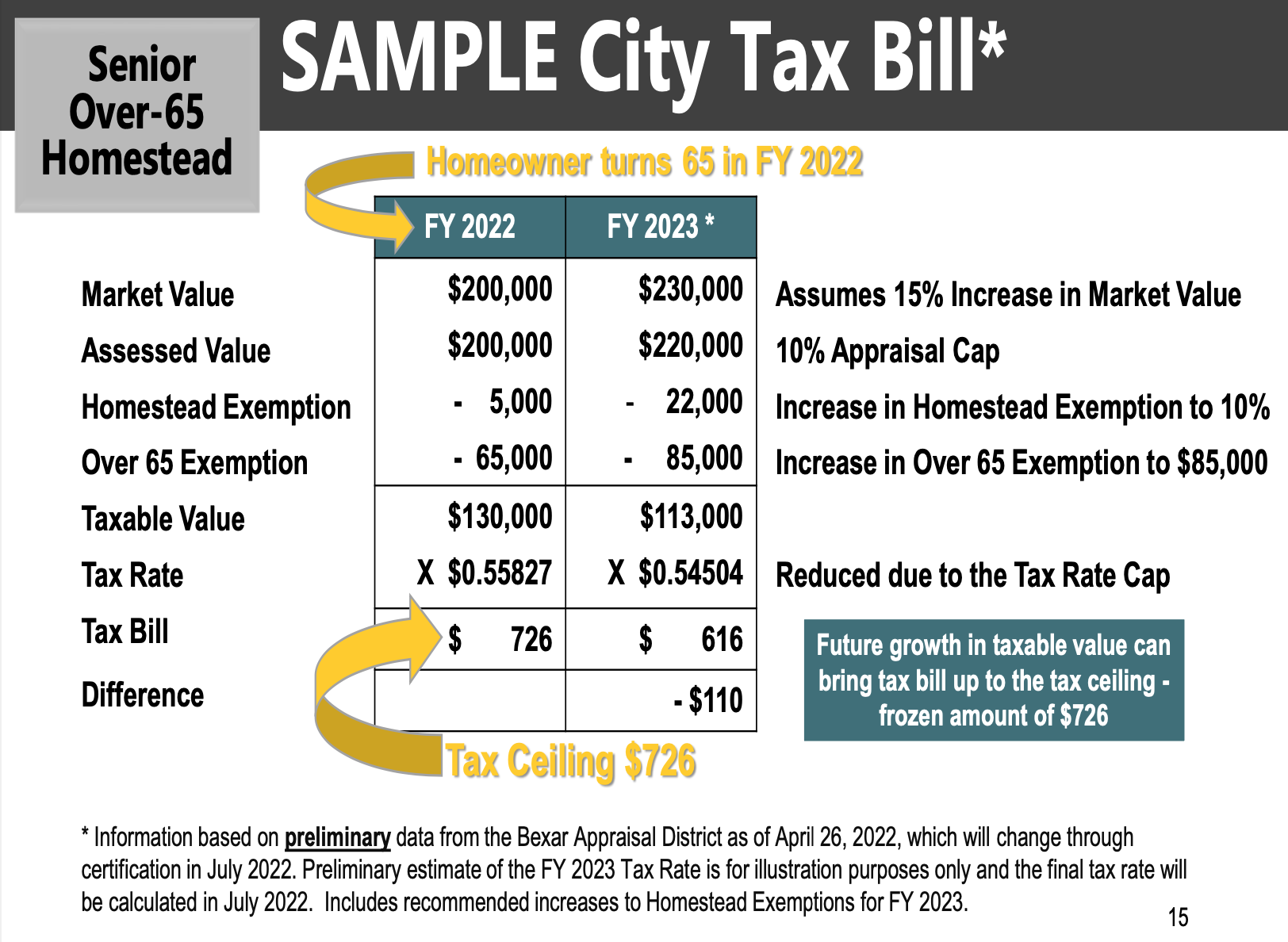

The property tax rate for the City of San Antonio consists of two components. In a unanimous vote of the 10 members present Thursday morning San Antonio City Council approved raising the homestead exemption from the minimum 001 or 5000. Search Any Address 2.

Throughout Bexar county of which San Antonio is the dominant player tax rates can. PersonDepartment 100 W. Alamo Community College District.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. China Grove which has a combined total rate of 172 percent. Object moved to here.

Rates will vary and will be posted upon arrival. For additional information regarding the appeal process please contact the Bexar Appraisal District at 210-224-8511 to speak to one of their appraisers. Search For Title Tax Pre-Foreclosure Info Today.

See Property Records Tax Titles Owner Info More. Setting tax rates appraising property worth and then receiving the tax. Rates will vary and will be posted upon arrival.

210 207-1337 SAN ANTONIO June 16 2022 Today the San Antonio City Council unanimously approved new. Jurors parking at the garage. Rates will vary and will be posted upon arrival.

As a property owner your most. The Fiscal Year FY 2022 MO tax rate is 34677 cents. San Antonio TX 78205.

Property not exempted has to be taxed evenly and uniformly at current market worth. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. San Antonio TX 78283-3966.

San Antonio residents pay almost 57 cents in property taxes per every 100 dollars. Jurors parking at the garage. Mailing Address The Citys PO.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. City of San Antonio Property Taxes are billed and collected by the Bexar County. Road and Flood Control Fund.

The tax rate varies from year to year depending on the countys needs. The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns. Property Tax Rate Calculation Worksheets by Jurisdiction.

If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1. They are calculated based on the total property value and total revenue. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

Monday - Friday 745 am - 430 pm Central Time.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

San Antonio City Council Provides Additional Property Tax Relief For Residents Kens5 Com

San Antonio Homeowners Get A Property Tax Break As Council Raises Exemption Rate

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Appraisal Animosity Fuels Push To Increase Homestead Exemptions In San Antonio Tpr

Tac School Property Taxes By County

San Antonio Homeowners Get A Property Tax Break As Council Raises Exemption Rate

San Antonio Homeowners Get A Property Tax Break As Council Raises Exemption Rate

Why Are Texas Property Taxes So High Home Tax Solutions

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

San Antonio Property Tax Rates H David Ballinger

Tac School Property Taxes By County

Property Tax Information Bexar County Tx Official Website

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket